I’m sure this has been asked before but does anyone have any info on driver hire and what exactly is a umbrella company

I was on the books of Driver hire East kilbride for a while for class 2 work. Was a specific contract so was consistent work. Once the contract ended I didnt get a lot from them however and ended up leaving. Things have changed now though,so they may well have more shifts and better wages now a days.

As for the whole umbrella company thing,it has something to do with the law changing regarding how offshore workers are paid and it has inadvertantly affected agency workers. I THINK. If anyone knows otherwise,let us both know! ![]()

What I will say though is that should you go down this route,you will be much better off each week in wages than with PAYE. The accounting firm will deal with all wages and work out your tax,expenses etc. You dont need to worry about it. I do agency work this way and I will not go back to PAYE

Avoid. Unless you want to pay £25 a week to get your wages

The-Snowman:

I was on the books of Driver hire East kilbride for a while for class 2 work. Was a specific contract so was consistent work. Once the contract ended I didnt get a lot from them however and ended up leaving. Things have changed now though,so they may well have more shifts and better wages now a days.

As for the whole umbrella company thing,it has something to do with the law changing regarding how offshore workers are paid and it has inadvertantly affected agency workers. I THINK. If anyone knows otherwise,let us both know!

What I will say though is that should you go down this route,you will be much better off each week in wages than with PAYE. The accounting firm will deal with all wages and work out your tax,expenses etc. You dont need to worry about it. I do agency work this way and I will not go back to PAYE

Are you on drugs or somefink ![]()

peter s:

The-Snowman:

I was on the books of Driver hire East kilbride for a while for class 2 work. Was a specific contract so was consistent work. Once the contract ended I didnt get a lot from them however and ended up leaving. Things have changed now though,so they may well have more shifts and better wages now a days.

As for the whole umbrella company thing,it has something to do with the law changing regarding how offshore workers are paid and it has inadvertantly affected agency workers. I THINK. If anyone knows otherwise,let us both know!

What I will say though is that should you go down this route,you will be much better off each week in wages than with PAYE. The accounting firm will deal with all wages and work out your tax,expenses etc. You dont need to worry about it. I do agency work this way and I will not go back to PAYEAre you on drugs or somefink

No. But I AM on around £50 a week more this way than PAYE. And thats WITH the £14 a week (NOT £25) they take to do all the accounting

They do offer PAYE but its monthly. I’m on the Umbrella thing, sure its annoying but I’m looking for full time work now so there isn’t much point ■■■■■■■ around changing it.

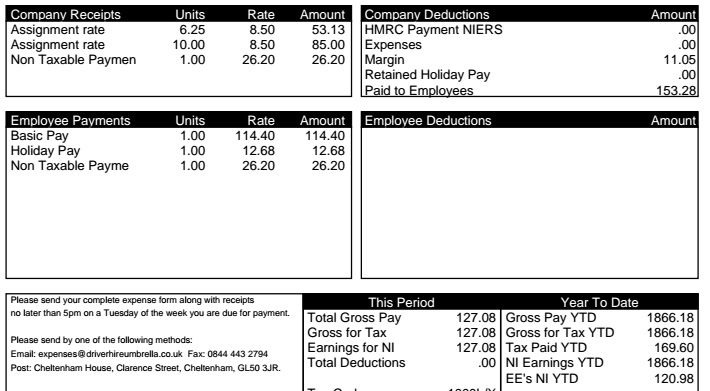

Thats my wage slip for last week. I did one day and 3 hours on Saturday.

They are a 3rd party company who will process your payroll in return for a fee (most will charge in the region of 5-7% or up to a maximum of £25-£30 from your weekly wage). Simply put they are a rip off and should be avoided. Agencies love them because they make money out of the driver by pushing you onto these schemes, Make no mistake about it the agency doesn’t sell them to you because its in your interest! Most will pay just a £1 an hour more than the PAYE rate but out of that you will end up paying their employers NI contribution, in all likelihood holiday pay will be built INTO and not ON TOP OF the hourly figure given rather than the 12.07% you earn through PAYE, there’s no guarantee the umbrella company will actually pay your tax and NI contributions at the end of the year and even if they do they’ve been accruing interest on your money for all that time.

The-Snowman:

peter s:

The-Snowman:

I was on the books of Driver hire East kilbride for a while for class 2 work. Was a specific contract so was consistent work. Once the contract ended I didnt get a lot from them however and ended up leaving. Things have changed now though,so they may well have more shifts and better wages now a days.

As for the whole umbrella company thing,it has something to do with the law changing regarding how offshore workers are paid and it has inadvertantly affected agency workers. I THINK. If anyone knows otherwise,let us both know!

What I will say though is that should you go down this route,you will be much better off each week in wages than with PAYE. The accounting firm will deal with all wages and work out your tax,expenses etc. You dont need to worry about it. I do agency work this way and I will not go back to PAYEAre you on drugs or somefink

No. But I AM on around £50 a week more this way than PAYE. And thats WITH the £14 a week (NOT £25) they take to do all the accounting

You are aware though that you will be paying the agencies national employers contributions and that your holiday pay will be built into the rate you get paid rather than on top of like with PAYE. Suddenly the £50 doesn’t look so appealing. Why don’t you do it properly and set yourself up as a LTD Co. You can get a good accountant who will do everything the umbrella company does (and has more credibility in the eyes of HMRC) for half the £728 your paying a year to the umbrella company, you can claim so many more genuine expenses to offset against your tax bill, add on the 20% VAT you can charge as a small business and make sure you get more than £1 per hour over the PAYE rate and your laughing.

tmcassett:

The-Snowman:

peter s:

The-Snowman:

I was on the books of Driver hire East kilbride for a while for class 2 work. Was a specific contract so was consistent work. Once the contract ended I didnt get a lot from them however and ended up leaving. Things have changed now though,so they may well have more shifts and better wages now a days.

As for the whole umbrella company thing,it has something to do with the law changing regarding how offshore workers are paid and it has inadvertantly affected agency workers. I THINK. If anyone knows otherwise,let us both know!

What I will say though is that should you go down this route,you will be much better off each week in wages than with PAYE. The accounting firm will deal with all wages and work out your tax,expenses etc. You dont need to worry about it. I do agency work this way and I will not go back to PAYEAre you on drugs or somefink

No. But I AM on around £50 a week more this way than PAYE. And thats WITH the £14 a week (NOT £25) they take to do all the accounting

You are aware though that you will be paying the agencies national employers contributions and that your holiday pay will be built into the rate you get paid rather than on top of like with PAYE. Suddenly the £50 doesn’t look so appealing. Why don’t you do it properly and set yourself up as a LTD Co. You can get a good accountant who will do everything the umbrella company does (and has more credibility in the eyes of HMRC) for half the £728 your paying a year to the umbrella company, you can claim so many more genuine expenses to offset against your tax bill, add on the 20% VAT you can charge as a small business and make sure you get more than £1 per hour over the PAYE rate and your laughing.

Might I interject here, won’t the agency get funny if you go from Umbrella to LTD Co?

Radar19:

tmcassett:

The-Snowman:

peter s:

The-Snowman:

I was on the books of Driver hire East kilbride for a while for class 2 work. Was a specific contract so was consistent work. Once the contract ended I didnt get a lot from them however and ended up leaving. Things have changed now though,so they may well have more shifts and better wages now a days.

As for the whole umbrella company thing,it has something to do with the law changing regarding how offshore workers are paid and it has inadvertantly affected agency workers. I THINK. If anyone knows otherwise,let us both know!

What I will say though is that should you go down this route,you will be much better off each week in wages than with PAYE. The accounting firm will deal with all wages and work out your tax,expenses etc. You dont need to worry about it. I do agency work this way and I will not go back to PAYEAre you on drugs or somefink

No. But I AM on around £50 a week more this way than PAYE. And thats WITH the £14 a week (NOT £25) they take to do all the accounting

You are aware though that you will be paying the agencies national employers contributions and that your holiday pay will be built into the rate you get paid rather than on top of like with PAYE. Suddenly the £50 doesn’t look so appealing. Why don’t you do it properly and set yourself up as a LTD Co. You can get a good accountant who will do everything the umbrella company does (and has more credibility in the eyes of HMRC) for half the £728 your paying a year to the umbrella company, you can claim so many more genuine expenses to offset against your tax bill, add on the 20% VAT you can charge as a small business and make sure you get more than £1 per hour over the PAYE rate and your laughing.

Might I interject here, won’t the agency get funny if you go from Umbrella to LTD Co?

No, why would they? They are still making money out of using your services whether you are PAYE, Umbrella scam or Ltd Co. They just make the least with people on PAYE because they have to pay holiday pay, sick pay, employers National Insurance, payroll costs ect With a Ltd Co. the same as an umbrella company the agency won’t have to pay any of these things. Perhaps the only thing they are losing out on is a fee of some-sort from the umbrella company for getting the driver onto the scheme. Then they just hope that the drivers accept the just £1 per hour more than PAYE for it to be really beneficial to them.

tmcassett:

They are a 3rd party company who will process your payroll in return for a fee (most will charge in the region of 5-7% or up to a maximum of £25-£30 from your weekly wage). Simply put they are a rip off and should be avoided. Agencies love them because they make money out of the driver by pushing you onto these schemes, Make no mistake about it the agency doesn’t sell them to you because its in your interest! Most will pay just a £1 an hour more than the PAYE rate but out of that you will end up paying their employers NI contribution, in all likelihood holiday pay will be built INTO and not ON TOP OF the hourly figure given rather than the 12.07% you earn through PAYE, there’s no guarantee the umbrella company will actually pay your tax and NI contributions at the end of the year and even if they do they’ve been accruing interest on your money for all that time.

Best comment so far regarding this con …

somebody comes up to you, and tells you that they want you to earn more money, without simply paying you more?

As an employed driver, which yo are…

you are not self employed, you are working for an agency. the taxman regards that as employed…

a lot of people are going to wake up to some awkward letters soon…

All I know (and really care about to be honest) is that by using umbrella company and being self employed (even if thats just in name and im not technically SE) is that full time per hour I am looking at roughly £8-£9 per hour. For a 55 hr week,that’s £495. Take off tax = round about the £360 mark,being generous. Plus any things you buy such as safety footwear,gloves,bag etc and also other expenses like travel costs,meal costs,laundry etc all have to come out of this. That’s based on £9. Most jobs are paying less than that.

Go through agency and umbrella I get £12,rising to around £14 for weekends. For a 55 hr week,thats £660. From this comes tax obviously but I can claim travel expenses,meals,any work related items etc. That leaves me getting each week roughly £540.

Of course some weeks I don’t do 55hrs. But I have never been paid less than £430 for any one week. That’s for a four day week too.

I am not on here to champion for umbrella companies vs PAYE or full time employment. I’m also not saying the accounting firm or agency don’t benefit from it more either. All im saying is my only real concern is my bottom line and how much I walk away with after a working week.

The-Snowman:

All I know (and really care about to be honest) is that by using umbrella company and being self employed (even if thats just in name and im not technically SE) is that full time per hour I am looking at roughly £8-£9 per hour. For a 55 hr week,that’s £495. Take off tax = round about the £360 mark,being generous. Plus any things you buy such as safety footwear,gloves,bag etc and also other expenses like travel costs,meal costs,laundry etc all have to come out of this. That’s based on £9. Most jobs are paying less than that.

Go through agency and umbrella I get £12,rising to around £14 for weekends. For a 55 hr week,thats £660. From this comes tax obviously but I can claim travel expenses,meals,any work related items etc. That leaves me getting each week roughly £540.

Of course some weeks I don’t do 55hrs. But I have never been paid less than £430 for any one week. That’s for a four day week too.

I am not on here to champion for umbrella companies vs PAYE or full time employment. I’m also not saying the accounting firm or agency don’t benefit from it more either. All im saying is my only real concern is my bottom line and how much I walk away with after a working week.

Its that sort of naive and gullible attitude that is going to potentially land you with a large tax bill further down the road. You have just admitted the fact you know you are not self employed. I assume you are keeping and filing all receipts for the things you are claiming or let me guess the umbrella company told you that you don’t need them?

As mentioned above though you are not self employed, as far as HMRC goes you are an employee and as such are leaving yourself open to trouble. To avoid that you either need to be PAYE and put in a claim via a p87 form at the end of the year (HMRC will decide what you can legally claim) or set yourself up as either a Ltd Co. or become a sole trader.

There is a lot of scare-mongering goes on in relation to the whole Ltd Co. thing and HMRC but if you do it properly you have nothing to worry about but if HMRC are clamping down and investigating anything then it’s umbrella companies that will be top of their radar. Guess who will be landed with a big back dated tax bill - clue, it won’t be the agency or umbrella company.

oh my god this again!

right as mentioned some charge between 5-7% (nova who are on of the biggest charge 3% ![]() ). if you work on even £10 per week this is around £450-500 in ‘fees’, you could get an accountant for this.

). if you work on even £10 per week this is around £450-500 in ‘fees’, you could get an accountant for this.

yes most agencies will ‘offer’ £1 more than the normal rate - this is negotiable depending on what you want/experience/demand etc. ( yes its is saving 12.7% to the agency but seeing as most work out holidays over an average of 12 weeks etc it still may be better to take the £1 an hour).

to some your better off on PAYE (holidays etc.)

to others you earn more Umbrella/Ltd (higher wage/take home/dont take many hols etc), if i was to go back driving i would go this way as normally only work 3-4 days so the higher take home would be more appealing than a low paid holiday day rate.

as for the WHOLE hmrc sending letters etc. they looked into it this year and the schemes were adapted to keep in line with the HMRC.

out of curiosity were you given the CHOICE as to umbrella or Paye?

The-Snowman:

All I know (and really care about to be honest) is that by using umbrella company and being self employed (even if thats just in name and im not technically SE) is that full time per hour I am looking at roughly £8-£9 per hour. For a 55 hr week,that’s £495. Take off tax = round about the £360 mark,being generous. Plus any things you buy such as safety footwear,gloves,bag etc and also other expenses like travel costs,meal costs,laundry etc all have to come out of this. That’s based on £9. Most jobs are paying less than that.

Go through agency and umbrella I get £12,rising to around £14 for weekends. For a 55 hr week,thats £660. From this comes tax obviously but I can claim travel expenses,meals,any work related items etc. That leaves me getting each week roughly £540.

Of course some weeks I don’t do 55hrs. But I have never been paid less than £430 for any one week. That’s for a four day week too.

I am not on here to champion for umbrella companies vs PAYE or full time employment. I’m also not saying the accounting firm or agency don’t benefit from it more either. All im saying is my only real concern is my bottom line and how much I walk away with after a working week.

The example you give may be a bit skewed. I do not know of any agency that pays an extra £3 to £4 on the rates (£8-£9 going to £12). It is also not comparable to use the weekday rate in the PAYE and the £14 weekend rate for the umbrella. In any case £14 for an umbrella or Ltd is very low for weekends if that includes Sundays.

The agency I currently work for pay an extra £1.25 for Saturday and £1.50 on Sunday. I do not know the weekday rates as I am an old codger and only work weekends. The Rates go from £12 to £13.25 on a Saturday and on Sunday the rate goes from £15.00 to £16.50.

On the Saturday rate of £12.00 PAYE you will be entitled to (as tmcassett stated) an extra 12.07% holiday pay which makes the £12.00 rate £13.44 with hol pay.

On the Sunday rate of £15.00 PAYE you will entitled to the same 12.07% holiday pay which makes the £15.00 rate rise to £16.81.

So at the agency I work for you may drop 6 pence on Saturday but get 31 pence more on Sunday.

On the umbrella rates at the agency I work for you will also pay a £15.00 per week processing fee and you will need to pay EMPLOYERS NI as well as employees NI. Employers NI is 13.8% (depending on your NI category letter) on taxable pay between £153 to £770. ■■

You may well be able to claim meals and mileage on the umbrella but only if you satisfy the conditions of HMRC and if you do satisfy the conditions of HMRC then you can still claim for meals and mileage even though you may be on PAYE with an agency.

The mileage claims are based on travel to and from a temporary work place and the meals are based on mobile workers being away for more then 5 hours = £5 meal or more than 10 hours = 2 x £5 meals. The 5 and 10 hours are calculated from your front door back to your front door so include not only working time but also travelling time.

In short you are worse off with umbrellas. You may get a little bit more per week but this is usually funded by your loss of holiday pay.

shake - i would check you are accruing holiday pay on a weekend!

a lot of places you dont accrue on a weekend as it is classed as overtime (depending on the contract).

war1974:

shake - i would check you are accruing holiday pay on a weekend!a lot of places you dont accrue on a weekend as it is classed as overtime (depending on the contract).

Thanks for you comment war 1974. I am by no means an expert but I have been cheated out of holiday pay in the past so i did some digging and came upon the bits of the law that governed holiday. It is the law that counts over any companies contracts.

I started with the Employment Rights Act 1996 which is the bit of law that governs the amount of a weeks pay and I looked at Chapter (11) A Weeks Pay s221 to s224.

This bit of legislation is applicable to a workers who have normal working hours and workers with no normal working hours.

s221 states “This section and sections 222 and 223 apply where there are normal working hours for the employee when employed under the contract of employment in force on the calculation date.”

However s224 states Employments with no normal working hours. “This section applies where there are no normal working hours for the employee when employed under the contract of employment in force on the calculation date.”

There is no provison in s224(2) to exclude any pay that a worker gets during the course of his work.

As a worker with no fixed starting times working on different days of the week with varying shift lengths I workd argue that most agency workers are workers with no normal hours of work.

i have used this legislation in the small claims court with one agency (won), in altenative dispute resolution with another agency and succeeded in getting what I considered the correct holiday pay.

After a person uses the ERA 1996 to calculate thier pay rate then you need to calculate the amount of holiday owed. Each worker in the UK is entitled to 5.6 weeks (28 days) holiday (pro rata part time) and this works out to 12.07% of your working time as follows

52 weeks in the year minus the 5.6 weeks holiday gives 46.4 weeks to earn the 5.6 weeks holiday.

5.6 weeks as a percentage of 46.4 gives (5.6/46.4*100) 12.06896551724138% which is rounded up to 12.07%.

If you go to the Governments holiday pay calculator at gov.uk/calculate-your-holiday-entitlement and choose the casual or irregular hours option and insert 10 hours as the number of hours worked it gives a figure of 1 hour and 12 minutes as the holiday entitlement. Just as would 10 hours times 12.07 % (10 x12.07 = 1.207 hours where .207 of an hour is 12 minutes)

So in a nutshell a worker with no normal working hours is entitled to holiday pay on all hours worked. His rate of pay is an average of all pay recieved over the previous 12 weeks on all hours worked and where he did not get any renumeration in any of the preceding weeks that week is ignored and an earlier week is substituted. While the total entitlement is capped at 5.6 weeks.

Too many armchair experts on this site…