Evening all,

I could make this a long interminable post explaining how a vehicle manufacturer arrived at a certain specification/pricing ratio for a given market, and how his research, (via in the main, National Governmental statistical records, in the case of the UK Society of Motor Manufacturers and Traders regional registration records…known as “tabs”), would have pointed him in the direction of specifications that would have market advantage over other offerings in the market place. There are other considerations, are they trying to “dump” an old product cheaply, to gain market share, are they seeking to “outspec” the opposition to gain a reputation for value, are they trying to chip away at the market leaders business in any particular sector?

Each of these strategies would be specific to an area of the market where the manufacturer saw potential market, or advantage for “his” product growth/ or wished to increase his market share. For instance in the UK you would have catergories, ( in the 70/80s) such as, 7.5 tonne 2 axle, 16tonne 2 axle, multiaxle 20/28 tonnes, 28 tonnes plus etc.

Then of course we have to bear in mind the influence of his Dealer Network…were they “independents”, or Factory owned outlets, for their success, and profitability are vital to the manufacturer. And of vital importance the “Factory Gate Price/ Achievable retail Market Price” . This , most closely guarded of all statistics determines the true future viability of any vehicle manufacturer. Then of course the currency exchange rate, of vital importance to overseas manufacturers, and best illustrated in true terms when considering the " market acceptable"retail price of 60/70s Scandanavian lorries, versus the price of their replacement components over the counter in the Dealership Parts Departments. A classic case of one end "subsidising " the other. A similar example can be cited for German sourced products.

So how did it all work in practice? Given that the average independent Truck Franchised Dealer was signed up to a minimum stock commitment of X chassis, against a volume target based on National Market share, on a credit agreement with interest payable after a certain period, (commonly known as a “floor plan”). His terms would be list price less a discount, varying between 20/25%, subject to an extra “bonus” payable by the manufacturer either against a pre determined volume target, or for “conquesting” a new operator in his geographic area. Then of course there were other incentives as and when required…So if as an operator you wished to buy a xyz 4x2 TU, and the local Dealer had one in stock, and he was just about to start paying interest on that chassis on his “floor plan”, or he had convinced the factory that you were of vital importance to be seen running an xyz…then Sir, you were in the pound seats!!

Now Anorak asked for specifics…and my knowledge is “well past its sell by date”, but today, as part of my “phased” return to work,( and running the new knee in), I was allowed to cleanse some old files and transfer them to my new office in the cow shed! One that I have kept relates to our Contract Hire business back in the 80s. To be specific 88, E & F registration, so lets just look at some of my acquisitions during that period…

Tractor Units, Volvo FL10 4x2 sleepers, sliders, night heaters, paint,ready for the road, 29k

Scania P320 " " " " “” 31.5k

DAF 95 350 " " " 34K

Scania P93 4X2 sleeper/ Chereau Thermo King Fridge rigid 40k

Then if we go to 89, G reg,

Volvo F10 Globetrotter 4x2 slider, night heater paint ready for the road 28.9k

ERF E14 14 litre ■■■■■■■ rest cab 4x2 spec as above 26k

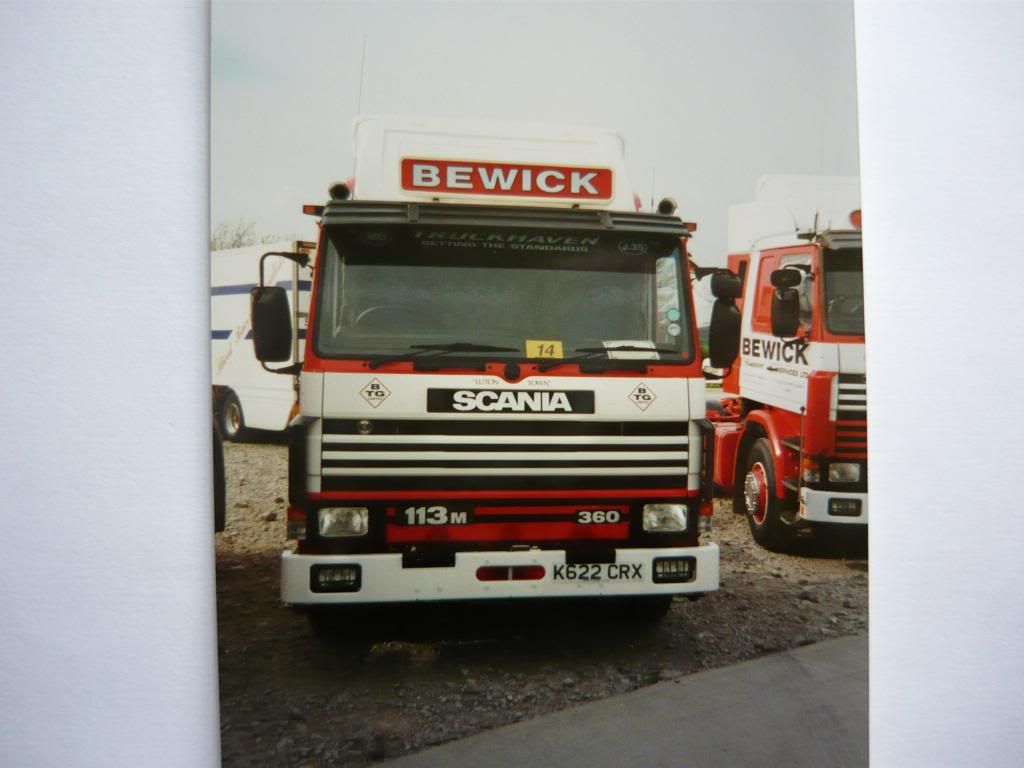

Scania R 360 4x2 sleeper spec as above 33k

Seddon Atkinson Stratocruiser, ■■■■■■■ as above 31k

Scania P93 4x2 sleeper spec as above 26k

Scania P360 4x2 sleeper spec as above 28k

Steyr sleeper 4x2 Chereau, Thermo King fridge 34k

Now the above prices are as shown on our audited accounts, but do not allow for Manufacturers over riding discounts, (whereby a vehicle manufacturer would pay to us an additional payment at the end of a period because we had “met” a pre agreed volume target, over a 12 month period). The prices are not for “one off” transactions but for tranches of 5 units upwards.

Some may have bought cheaper, some may not, but with the credit periods we enjoyed then even looking back I am not displeased. Interesting how close the actual total costs of acquisition actually are, irrespective of type of product. Our client base was almost exclusively own account, so payload, and compatability with other products on their fleet was a vital concern…you did not put a 142 into a fleet running FL10s!

Hope it is of interest, and I have not bored you!

Cheerio for now.